|

| Image: Etsy / NandaHouse |

Main Findings

Mindfulness in Financial Decisions: Kakeibo emphasizes mindful spending by encouraging individuals to reflect on their financial habits. It focuses on understanding the "why" behind purchases, helping users to avoid impulse buying and make more thoughtful financial decisions. Simple and Accessible: Kakeibo relies on a manual, pen-and-paper approach, making it simple and accessible for everyone, regardless of their level of financial expertise or technological proficiency. It doesn’t require any complicated tools or software. Reflection-Oriented Saving: The method encourages users to engage in monthly reflection through four fundamental questions that analyze income, savings goals, spending, and areas for improvement. This reflective process helps individuals gradually adjust their financial habits.

Kakeibo (pronounced "kah-keh-bo") is a traditional Japanese saving method that has gained global recognition for its simplicity and effectiveness in managing personal finances.

Often translated as "household financial ledger," Kakeibo encourages individuals to consciously track and analyze their spending habits. The method doesn't rely on complex budgeting tools or financial apps but instead promotes a pen-and-paper approach, fostering mindfulness around money management.

The core idea of Kakeibo is to bring awareness to how money flows in and out of your life, helping you to make informed decisions about spending and saving. It is more than just a financial technique; it is a mindset that encourages frugality, prioritization, and deliberate living, making it especially appealing for those looking to regain control over their finances in an increasingly consumer-driven world.

The Origins and Philosophy Behind Kakeibo

Kakeibo was first introduced in 1904 by Hani Motoko, Japan’s first female journalist. She created the concept as a way to help Japanese housewives manage household budgets more effectively. At a time when financial literacy was limited, especially for women, Kakeibo provided a straightforward tool to track income and expenses, promoting financial stability within families.

The philosophy behind Kakeibo is deeply rooted in mindfulness and intentional living. It encourages people to not only record their expenses but also reflect on their spending behaviors. The method is not just about cutting costs but about making purposeful decisions that align with personal priorities and long-term goals.

By consciously engaging with the process of saving and spending, individuals become more aware of unnecessary expenditures and are empowered to make changes to improve their financial well-being.

The simplicity of Kakeibo lies in its lack of reliance on technology or complicated accounting methods. Instead, it focuses on cultivating self-discipline and careful consideration of what truly matters, which aligns with broader principles of minimalism and mindfulness found in Japanese culture.

|

| Image: Etsy / NandaHouse |

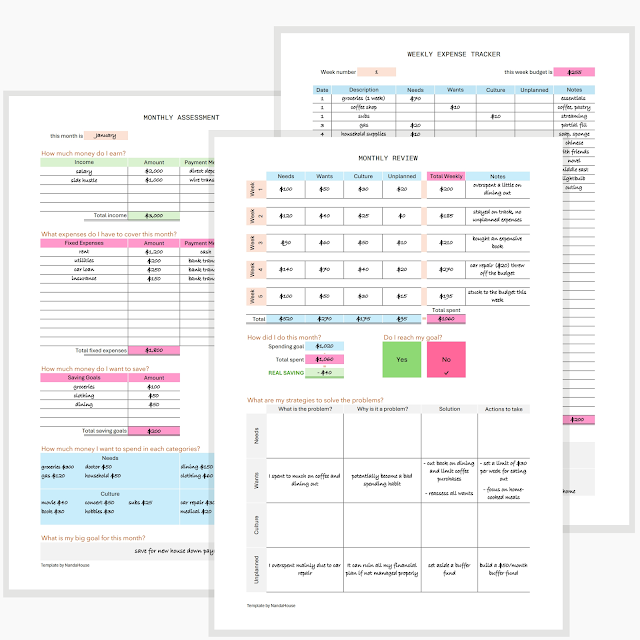

How Kakeibo Works: A Step-by-Step Approach

Kakeibo is a simple yet effective method for managing your finances, centered around four basic principles: tracking income, categorizing expenses, setting savings goals, and reflecting on spending. Here's how the process works step by step:

Step 1: Record Your Income

At the beginning of each month, start by writing down all sources of income. This could include salary, freelance work, investments, or any other earnings. By having a clear picture of how much money is coming in, you can better assess how much can be allocated towards savings and expenses.

Step 2: Track Fixed and Variable Expenses

The next step involves listing all your fixed and variable expenses. Fixed expenses are those that don’t change, such as rent, utilities, and loans, while variable expenses include groceries, entertainment, and dining out. Kakeibo requires you to be thorough and honest about all expenditures to ensure you capture an accurate overview of your spending habits.

Step 3: Categorize Your Spending

Kakeibo divides spending into four key categories:

- Needs: Essential expenses like food, housing, utilities, and transportation.

- Wants: Non-essential purchases such as dining out, entertainment, and hobbies.

- Culture: Expenses related to personal growth, such as books, music, or courses.

- Unexpected or Emergency Costs: Unplanned expenses like medical bills or car repairs.

By categorizing spending, Kakeibo helps you prioritize where your money goes and identify areas where you might be overspending.

Step 4: Set Savings Goals

Once you understand your income and expenses, set a realistic savings goal for the month. This goal should align with your long-term financial aspirations, whether it's building an emergency fund, saving for a vacation, or paying off debt. Kakeibo emphasizes consistent saving, even if it's a small amount each month.

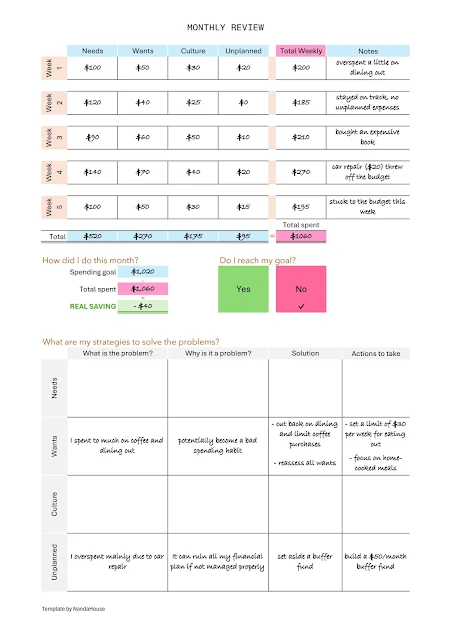

Step 5: Reflect and Adjust

At the end of the month, reflect on your spending habits and assess whether you met your savings goals. Kakeibo encourages introspection by asking:

- Where did you overspend?

- What could you have done differently?

- How can you improve next month?

This reflective process is key to making gradual, positive changes in financial behavior over time.

|

| Image: Etsy / NandaHouse |

The Four Fundamental Questions of Kakeibo

A unique aspect of the Kakeibo method is its reliance on four core questions, which guide users in making more mindful financial decisions. These questions are designed to prompt reflection before making purchases, helping individuals differentiate between necessary and unnecessary spending. The questions are:

1. How much money do you have?

This question requires you to evaluate your current financial situation. By understanding how much disposable income is available after accounting for essential expenses, you can determine what amount is left for discretionary spending or saving.

2. How much would you like to save?

Setting a savings target each month is a cornerstone of Kakeibo. This question encourages you to think realistically about your saving goals and align them with your overall financial plan. Whether it’s building an emergency fund or saving for a future goal, having a clear figure in mind helps keep you focused.

3. How much are you spending?

This question pushes you to actively monitor and track your spending throughout the month. Kakeibo asks you to look at both fixed and variable expenses, making you aware of where your money is going and whether you are staying within budget.

4. How can you improve?

The final question is one of reflection. After assessing your income, savings, and spending patterns, consider how you can improve your financial behavior. Can you reduce unnecessary expenses? Are there areas where you can save more? This question fosters self-awareness and drives long-term change.

By regularly engaging with these four questions, Kakeibo practitioners develop a deeper understanding of their financial habits, ultimately leading to smarter decisions and improved savings outcomes.

Benefits of Using Kakeibo for Financial Management

Kakeibo offers several unique benefits that make it an appealing and effective method for managing personal finances. Here are some of the key advantages:

Mindful Spending

One of the main principles of Kakeibo is cultivating mindfulness around spending. By actively tracking your expenses and reflecting on your purchasing decisions, you become more aware of unnecessary or impulsive purchases. This awareness helps you shift your focus from immediate gratification to long-term financial stability.

Improved Savings Habits

Kakeibo emphasizes consistent, purposeful savings. By setting monthly savings goals and regularly reviewing your progress, the method helps build discipline. Over time, this can lead to stronger saving habits that become part of your everyday financial routine, making it easier to reach financial milestones.

Simplicity and Accessibility

Unlike many modern budgeting tools that require apps or software, Kakeibo relies on simple pen-and-paper methods. This simplicity makes it accessible to anyone, regardless of technological proficiency. You don’t need any special skills to begin using Kakeibo, and the act of writing things down can increase the sense of accountability.

Reduces Financial Stress

By providing a clear and structured approach to financial management, Kakeibo can reduce the anxiety often associated with handling money. Knowing exactly where your money is going and having a plan for your finances can create a sense of control and confidence, reducing financial stress.

Adaptability to Any Lifestyle

Whether you are managing a household budget, living on a tight student budget, or planning for retirement, Kakeibo can be adapted to fit your personal financial situation. It doesn’t impose strict rules but rather offers a flexible framework that can be tailored to individual needs and goals.

These benefits make Kakeibo not just a method for saving but a holistic approach to financial well-being that encourages thoughtful, sustainable financial practices.

How to Get Started with Kakeibo

Beginning your journey with Kakeibo is straightforward and requires only a few basic tools. Here is a step-by-step guide to help you get started:

Step 1: Gather Your Tools

Kakeibo requires nothing more than a notebook, a pen, and your commitment to tracking your finances. While you can use pre-designed Kakeibo journals that are readily available, a simple blank notebook will work just as well. Some people prefer a digital alternative, but traditionally, writing by hand is thought to create a stronger connection with the process.

Step 2: Track Your Income and Expenses

At the start of the month, write down your total income and list all of your fixed and variable expenses. This will give you a clear picture of your financial standing and help you see what money you have available after meeting your essential obligations.

Step 3: Set a Monthly Savings Goal

Decide on a realistic amount you want to save by the end of the month. Your savings goal should be attainable based on your income and regular expenses. Make sure this goal aligns with your broader financial objectives, whether it's saving for an emergency fund, a major purchase, or simply building good habits.

Step 4: Categorize Your Spending

As you go through the month, categorize all of your purchases into the four key categories: Needs, Wants, Culture, and Unexpected Costs. This helps you identify which areas of your spending are necessary and which might be reduced. Reviewing these categories regularly is a crucial part of the Kakeibo process.

Step 5: Reflect at the End of the Month

At the end of the month, review your spending habits. Did you meet your savings goal? Where did you overspend? What can you do differently in the following month? By reflecting on your performance, you can make adjustments to improve your financial situation over time.

Step 6: Repeat and Refine

Kakeibo is a continuous process of learning and refining. The more you engage with it, the better you will become at managing your money and reaching your financial goals. Each month is an opportunity to improve your habits and increase your savings.

Starting with Kakeibo can be a transformative step toward better financial control. The key is consistency and honest reflection on your spending behaviors.

Kakeibo in Modern Financial Planning

Although Kakeibo originated over a century ago, its principles are still highly relevant in modern financial planning. In today's fast-paced, consumer-driven world, where digital payments and online shopping can lead to impulse purchases, the mindfulness that Kakeibo promotes is more important than ever.

A Counterbalance to Digital Financial Tools

While modern financial tools like budgeting apps and digital expense trackers offer convenience, they often lack the intentionality and reflection that Kakeibo provides. Many people using apps may automate their tracking without truly engaging with their financial habits.

Kakeibo, on the other hand, encourages manual effort, ensuring that each expenditure is noted and reviewed with care. This manual approach fosters a deeper connection to personal financial behavior, making it easier to spot patterns and make improvements.

A Fit for Any Budget

Kakeibo is suitable for any income level, making it a flexible tool for individuals at different stages of financial life. Whether you're managing a tight budget or seeking to maximize surplus income, the method can be adapted to your specific needs. By focusing on essential spending and reducing wasteful expenditures, Kakeibo encourages everyone, regardless of financial background, to develop healthier financial habits.

Long-Term Financial Sustainability

Unlike many short-term savings hacks or trends, Kakeibo emphasizes gradual, consistent progress. It aligns well with modern financial planning strategies focused on long-term wealth building and financial stability.

The reflective nature of Kakeibo can also complement more advanced financial planning techniques, such as retirement savings or investment strategies, by helping individuals focus on living within their means while contributing regularly to savings.

Mindful Consumption in a Consumer-Driven Society

Kakeibo is especially relevant in a time when consumerism is at its peak. The method teaches individuals to critically assess their purchasing decisions, fostering a shift towards minimalism and intentional living. This aspect of Kakeibo aligns with growing global trends that emphasize sustainability, minimalism, and mindful consumption, further proving its applicability in today’s world.

By integrating Kakeibo with modern financial tools or personal savings strategies, individuals can gain a stronger sense of control over their money and make more deliberate choices about how they spend and save.

Conclusion: Why Kakeibo is a Powerful Tool for Saving

Kakeibo, the Japanese method of saving, offers a simple yet profound approach to managing personal finances. Its focus on mindfulness, intentionality, and reflection sets it apart from many modern financial tools. By encouraging individuals to actively track their income and expenses, set savings goals, and critically reflect on their spending habits, Kakeibo promotes long-term financial well-being.

In a world dominated by digital transactions and constant consumer temptation, Kakeibo serves as a valuable counterbalance, helping people slow down and make thoughtful financial decisions. Whether you are new to budgeting or seeking a more disciplined savings approach, Kakeibo provides a structured framework that can be tailored to fit any lifestyle or financial situation.

Its adaptability, simplicity, and effectiveness make it a timeless method for anyone looking to regain control over their finances and build a sustainable path toward financial security.

By incorporating Kakeibo into your daily routine, you not only improve your savings habits but also develop a healthier, more mindful relationship with money—one that aligns with both your immediate needs and long-term goals.

You can purchase Kakeibo template here.

References

- Fumiko, C. (2017). Kakeibo: The Japanese Art of Saving Money. Tuttle Publishing.

- Kondo, M. (2014). The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and Organizing. Ten Speed Press.

- Takahashi, K. (2018). Minimalism and money: Exploring the cultural impact of Japanese saving techniques. Journal of East Asian Culture, 15(2), 45-61.

FAQ

No, you don't need a specific Kakeibo notebook to begin. While there are pre-designed Kakeibo journals available for purchase, you can use any notebook or even create your own system. The key is to consistently track your income, expenses, and savings manually.

Kakeibo differs from regular budgeting by focusing on mindfulness and reflection. Instead of merely tracking income and expenses, Kakeibo encourages a deeper connection with your financial habits through self-reflection questions. It is designed to make you more aware of how you spend and why, fostering long-term behavioral change rather than just short-term adjustments.

Kakeibo is traditionally intended for personal and household finances. However, its principles of mindful spending, reflecting on expenses, and setting savings goals can be adapted to small business finances. For large-scale business finance, though, more complex accounting tools would likely be more appropriate.

Kakeibo doesn’t require a significant amount of time. At the beginning of each month, you will spend some time setting your income, expenses, and savings goals. Throughout the month, you'll track your spending, which can take a few minutes a day. At the end of the month, you reflect on your spending and saving patterns, which typically takes around 15–30 minutes.

Yes, Kakeibo can work for individuals with irregular income, such as freelancers or part-time workers. The key is to estimate your expected income and plan your expenses accordingly. You can adjust your savings goals based on your earnings for each month, allowing for flexibility while still maintaining mindful spending.

Absolutely. Kakeibo can be an effective tool for debt repayment by helping you prioritize your expenses, cut unnecessary spending, and allocate more funds toward paying off debts. By focusing on what is essential and reflecting on spending patterns, you can free up more money to accelerate your debt repayment.

Yes, Kakeibo can be used in combination with digital budgeting apps. Some people prefer to manually track their expenses through Kakeibo while using digital apps for automatic updates or tracking their bank balances. The key is to maintain the reflective and mindful process that Kakeibo encourages.

Kakeibo is primarily focused on day-to-day spending and saving habits. While it doesn’t directly address investments or long-term financial planning, the discipline and awareness it fosters can lay the groundwork for better financial decision-making, including investments and retirement planning.

Yes, Kakeibo can be adapted for use by families or couples. By tracking combined household income and expenses, partners or family members can work together to set savings goals and reflect on spending patterns. This collaborative approach can lead to better financial harmony and shared financial goals.

Yes, Kakeibo is flexible and can be adapted to various living conditions, including high-cost areas. The method helps you focus on essential expenses, reduce wasteful spending, and allocate money towards savings, regardless of where you live. In high-cost areas, it can be especially useful for distinguishing between needs and wants.