|

| Image: Moneybestpal.com |

An asset-based approach is a method of valuing a business based on the market value of its net assets. Net assets are calculated by subtracting total liabilities from total assets. This strategy makes the supposition that a company's value is equal to the total of the costs associated with purchasing its assets less the commitments associated with paying down its debts.

An asset-based approach can be used for different purposes, such as:

- Liquidation: A business's ability to produce cash through the sale of its assets and settlement of its debts can be estimated using an asset-based approach when it is not a going concern or is about to file for bankruptcy.

- Acquisition: An asset-based approach can help an acquirer identify the minimal price to pay for the target company when a corporation is a going concern but its worth is closely related to the liquidation value of its underlying tangible assets and investments.

- Financing: Lenders and investors can evaluate the collateral value of a company's assets and the risk of default with the use of an asset-based strategy when a business seeks to acquire finance.

The book value method uses the values of assets and liabilities as reported on the balance sheet. Although this approach is straightforward and unbiased, it might not accurately reflect the assets' and liabilities' true market values, particularly if they are prone to impairment, depreciation, or obsolescence. Certain intangible assets that are not shown on the balance sheet, such as goodwill, patents, trademarks, and customer connections, may also be disregarded by the book value technique.

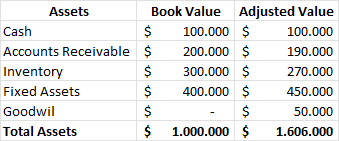

The adjusted net asset approach raises the book values of assets and liabilities to reflect their fair market values. Although this approach is more precise and realistic, it also involves more estimation and judgment. Intangible assets with a quantifiable market worth, like as goodwill, patents, trademarks, or customer relationships, may also be included in the adjusted net asset approach.

The following steps are involved in applying adjusted net asset methods:

- Determine and make a list of all the company's assets and liabilities.

- Equip assets and liabilities with their fair market values by adjusting the book values. This may entail utilizing replacement costs, discounted cash flows, market prices, appraisal values, or other valuation methods.

- To calculate the adjusted net asset value, subtract the adjusted value of all liabilities from the adjusted value of all assets.

- Apply any discounts or premiums, such as those for lack of marketability, lack of control, or synergies that may have an impact on the overall worth of the company.

|

| Image: Moneybestpal.com |

|

| Image: Moneybestpal.com |

Adjusted net asset value = Total adjusted assets - Total adjusted liabilities

= $1,060,000 - $340,000

= $720,000

Discount for lack of marketability = 10%

Discounted net asset value = Adjusted net asset value x (1 - Discount)

= $720,000 x (1 - 0.1)

= $648,000

The advantages of using an asset-based approach are:

- It is easy to understand and apply.

- It is based on objective and verifiable data.

- It is suitable for businesses that have significant tangible assets or are not profitable.

The disadvantages of using an asset-based approach are:

- It may not capture the value of intangible assets or future earnings potential.

- It may not reflect the strategic value or synergies of a business combination.

- It may not account for the effects of inflation or market changes on asset values.