|

| Image: Moneybestpal.com |

Appropriation Account is a term that refers to how an organization's funds are distributed among its partners, shareholders, or departments. It shows how the profits or revenues of an organization are allocated for different purposes, such as paying taxes, dividends, salaries, or reserves. Depending on the type of organization, an appropriation account may have different components and formats.

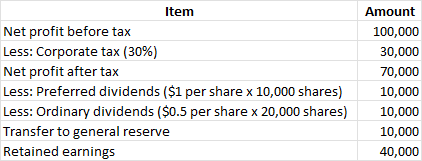

For companies, an appropriation account is usually an extension of the profit and loss statement, showing how the company's profits are divided between the owners and/or retained by the company. The account may include items such as corporate taxes, preferred dividends, ordinary dividends, and transfers to reserve accounts. The remaining amount is the retained earnings, which can be reinvested into the business or saved for future use.

For partnerships, an appropriation account shows how the net profits are distributed among the partners, according to their agreed terms. The account may include items such as interest on capital, salary to partners, and share of remaining profits. The distribution of profits may depend on factors such as the capital contribution, the role, and the performance of each partner.

For governments, an appropriation account shows how the funds are allocated to specific departments and projects, based on the budget approved by the legislature. The account may include items such as entitlements, discretionary spending, mandatory spending, and interest on debt. The allocation of funds may depend on factors such as policy priorities, economic conditions, and the revenue projections of the government.

Some examples of appropriation accounts are:

- A simple P&L appropriation account for a company: